The Latest – Interest Rates Cut, Poor Job Numbers, DOL Regulatory Agenda, Pay Transparency Upheld

On Sept. 17, the Federal Reserve voted for its first interest rate cut this year, lowering rates by a quarter of a point to a range of 4% to 4.25%. The Fed also projected that there will be another half-point rate reduction before the end of this year. The Fed meets again in October and December.

The expected cut came against the backdrop of fast-moving changes among the Fed’s Board of Governors. Stephen Miran, the Fed’s newest governor who was recently nominated by President Trump, was approved by the Senate just minutes before the Fed’s scheduled meeting this week.

And until late Monday, the participation of Fed Governor Lisa Cook at this week’s meeting was in question, as she sues to keep her position after Trump attempted to fire her last month. On Monday, a panel of judges ruled that Cook can stay on as a governor while her lawsuit contesting her firing goes forward. The White House is expected to appeal that ruling to the Supreme Court.

How Cook’s unprecedented attempted firing plays out in court is expected to have a significant impact on the Fed’s ability to set interest rates independent from political pressure.

On Sept. 5, the U.S. Department of Labor’s Bureau of Labor Statistics (BLS) released disappointing monthly employment numbers for August. The 22,000 jobs added to the U.S. workforce last month were well below the 75,000-80,000 jobs widely expected by analysts, and far below the 79,000 jobs added in July. The BLS also revised its Sept. report from 27,000 added jobs to 13,000 lost jobs.

The slowdown in hiring raised the unemployment rate to 4.3%, the highest since 2021.

Which sectors are losing the most jobs?

- The federal government continues to bleed workers in the wake of Trump’s defunding and closing of federal agencies and contracts. The number of federal employees is down 97,000 since January 2025, and that trend is expected to continue.

- Wholesale trade also continued to shed workers, losing 12,000 jobs in August, and 32,000 since May.

- Manufacturing shed 12,000 jobs, and 78,000 since May.

Which sectors are adding jobs?

- The healthcare sector continues to add jobs, a total of 31,000 in August. However, that’s below the average monthly gain (42,000) over the previous 12 months.

- Social assistance added 16,000 jobs, as families turn to these agencies for more support.

More Downward Revisions

A Sept. 9 preliminary annual report from the BLS reporting jobs revisions over the past 12 months through March 2025 found that the economy added 911,000 fewer jobs during that period than previously reported. This means the U.S. economy added only 850,000 jobs during that time, about half as many as previously thought. The unusual scale of this revision has led many economists to conclude that recent job reports may also be revised downward.

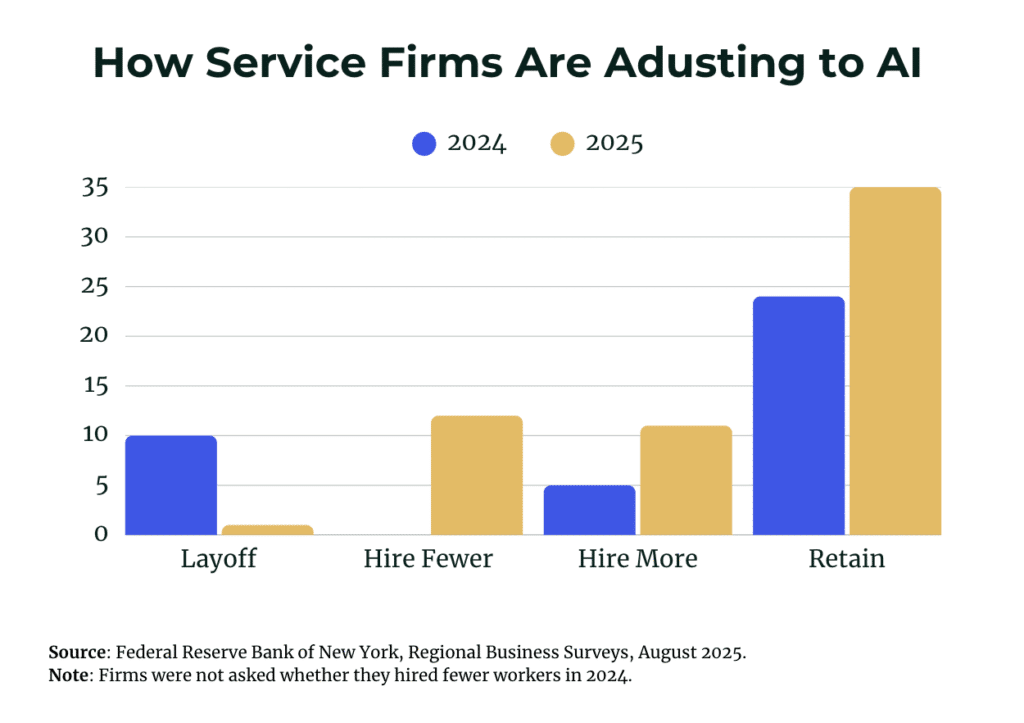

The Federal Reserve Bank of New York recently released the results of a business survey taken last month of companies in the New York/New Jersey region. The companies were asked whether they had used AI as part of their business processes in the past six months, whether they planned to use AI over the next six months, and whether those factors impacted their hiring.

Surprisingly, the survey found few layoffs in relation to AI usage.

While companies reported a significant increase in their usage of AI over the past year, few reported layoffs connected to that usage. Instead, the survey found that AI usage is more often correlated with job retraining than job loss. However, the survey did find that companies expect layoffs and scaled-back hiring as their AI use increases in the future—which will particularly impact college-educated employees.

Among the survey’s findings:

- 24% of the companies surveyed said they had retrained employees in response to their adoption of new AI technologies in 2024. That percentage grew to 35% thus far in 2025, and is expected to rise to 47% over the next six months.

- 10% of companies reported layoffs in response to more AI usage in 2024, and just 1% of companies reported such layoffs thus far this year. However, that percentage is expected to increase to 13% over the latter half of this year.

- 12% of the companies surveyed in 2025 said they had cut back on hiring this year due to AI adoption. They said they expect that percentage to increase to 23% over the next six months.

Other survey findings:

- HR professionals in Europe report feeling more energized and engaged in their careers than their U.S. peers do (85% and 72%, respectively).

- Respondents identified performance management and employee engagement as their top priorities in 2026.

- While 30% of respondents said they were prioritizing DEI issues in 2023, only 16% say they are doing so in 2026. However, high-performing HR teams are 5x more likely to prioritize DEI.

- Attitudes among survey respondents about their chosen career vary depending on the type of employer they work for. Of the HR employees who would most recommend their field:

- 77% work at blue-collar companies.

- 75% work at gray-collar companies.

- 56% work for white-collar companies.

- 70% of high-performing HR teams are likely to prioritize greater pay transparency (compared to 23% of low-performing HR teams).

- 69% of high-performing HR teams are likely to have executives who prioritize engaging with their workers (compared to 29% of low-performing teams).

- Establishing standards for heat injury and illness prevention in outdoor and indoor work settings.

- Improving the transparency of pharmacy benefit manager fee disclosures.

- Determining the extent to which fiduciaries may prioritize environmental, social, and governance factors in investment decisions.

- Examining the circumstances under which workers should be classified as employees or independent contractors for the purpose of federal wage and hour requirements.

- Determining whether certain salaried employees are exempt from FLSA minimum wage and overtime requirements

- Considering updates to the methodology used to calculate the prevailing wage for H-2A workers.

As pay transparency laws continue to spread across the country and employers grapple with new regulations in this area, these laws are being tested in court. On Sept. 4, the Washington Supreme Court ruled 6-3 for two individuals who had applied for positions at Total Wine & More Liquor.

The plaintiffs argued that since Total Wine did not include a salary range for this position in their job posting—as required by Washington’s Equal Pay & Opportunities Act—they were entitled to sue Total Wine for noncompliance with the law. The law, created to “address income disparities, employer discrimination, and retaliation practices, and to reflect the equal status of all workers in Washington state,” stipulates that any person who submits a job application in response to a noncompliant posting can sue for $5,000 in damages.

Total Wine said that the plaintiffs had no standing, as their intent to apply to the job posting was disingenuous, and Total Wine argued that the law’s protection of job applicants does not apply in this case. The court disagreed, writing in its decision, “A job applicant need not prove they are a ‘bona fide’ applicant to be deemed a ‘job applicant,’ regardless of the person’s subjective intent in applying for the specific position.

—

The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter.

- News & Compliance

The Latest includes a brief update on federal and state level news.

- Hiring & Recruitment

Culture fit persists because it is easy. Clear expectations require effort, discipline, and consistency. But ease is not the same as effectiveness. When organizations rely on vague notions of fit, they trade clarity for comfort and pay the price in disengagement, mistrust, and missed talent.

- Leadership Development

Gallup research shows that only about three in ten employees believe their opinions count at work, signaling open-door promises aren’t creating the space intended. Open-door policies came from the right place. They were designed to signal care, openness, and trust. But intent without structure no longer works.