Compliance Round Up – Government Shutdown, Social Media and Free Speech, AI Bias, and More

Federal News

Effective Date: Hits three-week mark Oct 21, 2025

What’s Changing:

What This Means for HR:

- Agency Engagement: Clients should anticipate delays in regulatory reviews, permitting and federal communications.

- Contracting and Grants: Federal contractors may experience payment disruptions and limited access to agency personnel.

- Policy Positioning: The shutdown may create new leverage points in legislative negotiations. Clients with interests in appropriations, healthcare, defense and infrastructure should monitor developments closely.

Resources

- How does a government shutdown impact states?

- What services are affected and how?

IRS Increase Commuter Benefits Limits

Effective Date: January 1, 2026

What’s Changing? The IRS is increasing the monthly pretax commuter benefits taking effect January 1, 2026.

- The IRS monthly pretax limit for both transit and parking benefits is increasing to $340 per month (up from $325 in 2025).

- Employees can set aside up to $4,080 per year tax-free for each benefit, for a potential total of $8,160 in pretax savings across both categories.

What This Means for HR:

- Review and update benefit plan documents if you have a qualified transportation plan or third-party commuter benefit.

- Coordinate with payroll and benefit vendors about the new limits that can be implemented in January. Confirm the system prevents employees from exceeding IRS limits.

- Include a short notice in your 2025 year-end or open-enrollment communications and highlight that increasing pretax contributions can help taxable income and commuting costs.

- Consider adding or expanding commuter perks.

- Ensure compliance with local ordinances.

Effective: Immediately

What’s Changing? The First Amendment only protects individuals from government restrictions on speech — not private employers. In private workplaces, employees do not have a constitutional right to free speech. However, some off-duty social media activity may still be protected under other laws, such as:

- Title VII (if posts involve reporting or opposing discrimination or harassment).

- ADA (if posts relate to disability rights or requests for accommodation)

- NLRA (if posts involve concerted activity or discussion of working conditions)

- PHRA (Pennsylvania Human Relations Act) or similar state laws

What This Means for HR:

- Review and update social media and conduct policies. Your policy should distinguish between personal expression and conduct that violates company standards. Include language that disciplinary action may be taken for behavior that violates company policy, not simply for opinions.

- Train managers before they act. Not all controversial posts justify discipline. Require HR review before any action is taken for social media activity.

- Investigate and document decisions.

- Communicate expectations proactively during onboarding or policy rollouts.

- Stay current with state laws. Check for state-specific “off-duty conduct” or “social media privacy” laws that could limit employer discipline.

AI Bias Against Women

What’s Changing: A recent large-scale study found that major AI models (used for image generation, video analysis, and resume screening) tend to:

- Assume women are younger than men;

- Downplay women’s experience—especially in high-status or leadership roles;

- Generate AI-created resumes that present women as less experienced or qualified than comparable men.

These findings underscore the risk that AI-driven HR tools (for hiring, performance evaluation, and branding) can amplify gender bias, even when unintentional.

What This Means for HR:

- Audit AI tools for bias and transparency. Consider conducting a bias and impact assessment of any AI tools used for recruiting, resume screening, or other hiring processes.

- Require human oversight by ensuring AI outputs are reviewed by trained HR staff before hiring or performance decision is finalized.

- Review job descriptions and resume screening prompts by avoiding wording that might lead to AI models to infer gendered traits like “assertive leader”, “young, energetic team”.

- Train recruiters to recognize when AI recommendations show bias trends

- Document AI tool’s purpose, data source, and decision-making role.

- Communicate to senior leadership and employees on these findings and how your organization mitigates bias in automated tools.

- Stay ahead of compliance. States are developing laws associated with decision-making in AI including New York, Colorado, and California. HR should track these requirements and ensure early compliance rather than waiting until enforcement begins.

New Guidance for Calculating FMLA

Effective Date: September 30, 2025

What’s Changing: The U.S. Department of Labor’s Wage and Hour Division (WHD) clarified how to calculate the hourly equivalent of FMLA leave when an employee’s schedule includes:

- Mandatory overtime (hours the employee is required to work); and

- Voluntary overtime (hours the employee may choose to work).

The opinion letter confirms:

- Mandatory overtime hours must be counted when determining an employee’s FMLA leave entitlement, because they’re part of the employee’s regular workweek.

- Voluntary overtime hours generally are not counted, unless the employee has a consistent pattern of working them and they’re effectively expected by the employer.

What This Means for HR:

- Review how FMLA leave hours are calculated and ensure your tracking system uses the employee’s actual workweek, including mandatory overtime, to determine the total number of hours in a normal workweek.

- Recalculate FMLA entitlement as 12 workweeks of leave, converted to hours, based on that total.

- Clearly document whether overtime is required or optional.

- Update leave policies and payroll systems to reflect this DOL interpretation.

- Train managers and schedulers that required overtime counts towards the employee’s FMLA workweek and how to communicate schedule expectations in writing to reduce confusion.

- Recalculate balances when applicable for employees currently on FMLA leave who regularly work overtime.

- Maintain documentation keeping written records of how workweeks and overtime expectations are defined.

Trending State News

Pay Equity Enforcement Act

Effective Date: January 2026

What’s Changing: On Oct. 8, Gov. Gavin Newsom signed SB 642, the “Pay Equity Enforcement Act,” which strengthens the California Equal Pay Act: a law that prohibits employers from paying employees “at wage rates less than the rates paid to employees of the opposite sex or another race or ethnicity for substantially similar work.”

What This Means for HR:

- Update all job postings to include pay scale, which is a good faith estimate of the hourly or salary range reasonably expected to be paid upon hire, for employers with 15+ employees.

- Maintain records of each employee’s job title and wage rate history for duration of employment and three years after separation.

- Train recruiters and hiring managers: do not ask applicants about prior compensation or benefits or rely on salary history to determine whether or what to offer. You may ask about salary expectations.

- Create written pay scale documentation for all positions.

- Ensure third-party recruiters/posters are compliant.

Employer Pay Data Regulation

Effective Date: In phases beginning January 1, 2026 and January 1, 2027

What’s Changing: California’s existing pay data reporting requirements (for private employers with 100+ employees) are becoming significantly stricter through two phases of updates under the amended law:

-

Effective January 1, 2026 — Enforcement & Data Storage

-

Mandatory penalties: Courts must impose fines if the California Civil Rights Department (CRD) seeks enforcement.

-

-

-

- Penalties: up to $100 per employee for first violations and $200 per employee for repeat violations.

- Example: An employer with 500 employees could face $50,000–$100,000 in fines for failing to file.

-

-

-

Data storage rule: Employers must keep demographic data (race, ethnicity, sex) separate from personnel records.

-

-

Effective January 1, 2027 — Expanded Job Categories

-

- Job categories will increase from 10 EEO-1 categories to 23 SOC-based categories.

- This means new reporting granularity — for example, breaking out “Computer & Mathematical Occupations,” “Health Care Practitioners,” or “Chief Executives” instead of one broad “Professional” group.

What This Means for HR:

- Review and update your pay data reporting process.

- Strengthen your data infrastructure. Work with HRIS, payroll, or compensation vendors to map existing roles to the new 23 SOC job categories.

- Build a secure data storage protocol that keeps demographic data separate from personnel files (to comply with privacy and nondiscrimination rules).

- Audit pay equity and job classifications now.

- Conduct an internal pay equity analysis to identify disparities before expanded reporting takes effect.

- Review job titles and ensure they align with the correct SOC category definitions.

- Train HR and DEI staff. Train team members on SOC category definitions and how to classify employees correctly.

-

Personnel Record Requirements

Effective Date: January 1, 2026

What’s Changing: SB 513 clarifies that “personnel records relating to the employee’s performance” now also include education and training records. Employers that maintain such records must ensure they contain the following information:

- Employee’s name

- Name of trainer

- Date and duration of training

- Core competencies addressed (e.g., skills in equipment or software)

- Resulting certification or qualification

What This Means for HR:

- Employers should ensure that employees’ education and training records include the above-mentioned details and, upon an authorized request, produce those records within the 30-day statutory window.

Construction Trucking: Employees and Independent Contractors

Effective Date: January 1, 2026

What’s Changing: California launched the Construction Trucking Employer Amnesty Program, effective through January 1, 2029, allowing eligible construction contractors to:

- Voluntarily reclassify truck drivers who were previously treated as independent contractors;

- Settle past misclassification issues by paying back wages, payroll taxes, and related costs;

- Avoid full civil and statutory penalties that would normally apply under California’s strict worker classification laws (such as AB 5 and Labor Code §226.8).

This program is intended to encourage employers in the construction and trucking sectors to come into compliance proactively, rather than wait for an audit or enforcement action.

What This Means for HR:

- Conduct an internal worker classification audit by reviewing all individuals providing trucking or hauling services under independent contractor agreements. Evaluate whether those relationships meet the ABC Test under California law. Identify drivers who may qualify for reclassification under the amnesty program.

- Coordinate with legal, payroll, and accounting to assess eligibility for the amnesty program and prepare necessary documentation.

- Calculate potential back wages, taxes, and benefits owed for reclassified drivers.

- Apply for the Amnesty Program before the deadline by submitting the settlement agreement request to the California Labor Commissioner’s Office before January 1, 2029.

- Update contracts and policies to align with employee status for reclassified drivers.

- Train managers and project leads. Communicate changes to affected workers and clearly explain to reclassified drivers what the change means for their pay, taxes, benefits, and protections.

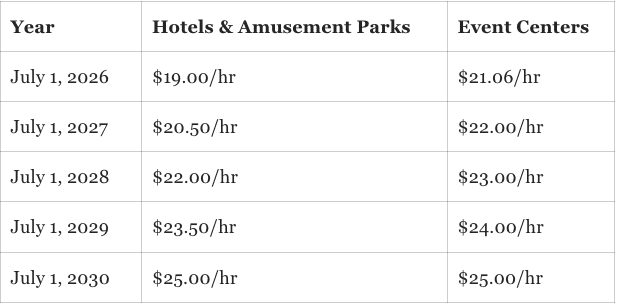

City of San Diego’s Hospitality Minimum Wage Increase

(JDSUPRA)

Effective Date:Increase July 1, 2026 with a steady increase until July 1, 2030

What’s Changing: The City Council has passed an ordinance establishing a new minimum wage schedule for employees at hotels, amusement parks, and event centers starting with an increase July 1, 2026 and a steady increase until July 1, 2030.

What This Means for HR:

- Adjust payroll systems for hotel employees, amusement parks, and event centers according to the table below:

Lactation Laws

Effective Date: January 1, 2026

What’s Changing? Both federal and state laws protect nursing employees’ rights to pump breast milk at work. Under federal law, employers must provide reasonable break time and a private space—other than a restroom—for expressing milk, though the time does not need to be paid. More than half of U.S. states, including District of Columbia, Arkansas, California, Colorado, Minnesota, Mississippi, New Hampshire, Oklahoma, South Carolina, and Tennessee that allow nursing mothers to pump during their scheduled break.

What This Means for HR:

-

Ensure the workplace has a clean, private, and functional space where employees can express breast milk.

-

The space must be:

- Shielded from view and free from intrusion (including by cameras or the public).

- Not a restroom.

- Equipped with:

- A chair and flat surface for a pump,

- Access to electricity, and

- Nearby running water and refrigeration (or a cooler) for milk storage when feasible.

- The space may be temporary (e.g., converted office or conference room) if it meets the above privacy and accessibility requirements.

- Allow reasonable time each time an employee needs to pump during the workday.

-

Breaks can be:

- Unpaid, unless the employee is not fully relieved of duties during the pumping time.

- Concurrent with regular paid breaks if the employee chooses.

-

Many states (including CA, CO, MN, TN, OK, AR, NH, SC, and DC) explicitly require that nursing breaks align with or occur during scheduled breaks when possible.

-

Develop and share a written lactation accommodation policy that explains:

- Employees can ask for lactation breaks and a private area.

- How to make a request and who to contact (HR or supervisor).

- Assurance that retaliation is strictly prohibited.

-

Include this policy in:

- The employee handbook, and

- New-hire onboarding materials.

-

Train supervisors to:

- Respond promptly and respectfully to lactation requests.

- Maintain confidentiality about nursing status.

- Coordinate scheduling to avoid disrupting workflow while meeting legal requirements.

-

Make sure they know the breaks are protected and cannot be denied or delayed.

Credit Checks in Hiring & Medical Debt Restrictions

Effective Date: January 1, 2026

What’s Changing? Particularly in financial services, where credit checks are more frequent, hiring managers must limit the use of credit information where it’s job-related and only a business necessity. On the federal level, they have faced setbacks to barring consideration of medical debt in consumer reports, so states have enacted their own laws. Several jurisdictions (including California, Illinois, and New York City) restrict the use of credit checks except in narrow circumstances. Some states, including New York and Rhode Island, have enacted statutes that restrict or prohibit the reporting or use of medical debt in employment or credit determinations.

What This Means for HR:

-

Review when and why your organization conducts credit checks as part of hiring or promotion.

- Ensure they are job-related and consistent with business necessity, especially for roles involving financial management, fiduciary duties, or sensitive data access.

-

Eliminate blanket credit check practices. Only use credit reports for positions where legally and operationally justified.

-

Confirm you are following both the Fair Credit Reporting Act (FCRA) and applicable state or local credit privacy laws (e.g., CA, CO, IL, NY, CT, NV, WA have restrictions).

- If a credit report contains medical-related information, ensure it is not factored into hiring decisions. Train hiring managers that medical or disability-related financial data may trigger ADA, PWFA, or GINA implications.

-

Update internal procedures to prevent potential violations of:

-

ADA (Americans with Disabilities Act): Avoid any consideration of medical debt or health-related financial info as evidence of disability or health status.

-

PWFA (Pregnant Workers Fairness Act): Do not consider pregnancy-related expenses appearing in credit history.

-

GINA (Genetic Information Nondiscrimination Act): Do not seek or use any genetic or family medical information inferred from credit or insurance data.

-

-

Reinforce with hiring teams that credit information can inadvertently expose protected-class data — and must be handled confidentially.

Effective Date: December 23, 2025

What’s Changing? The Chester County Board of Commissioners recently adopted Ordinance No. ORD-2025-03, creating the Chester County Human Relations Commission (CCHRC) and enacting broad countywide nondiscrimination provisions covering employment, housing and public accommodations. The ordinance expands protected classes based on gender identity, gender expression, sexual orientation, marital and familial status, source of income, veteran status, and status as a victim of domestic or sexual violence.

What This Means for HR:

- If you are located in Chester County:

- Update anti-discrimination and anti-harassment policies in your handbook and other published materials to include new protected classes. Redistribute to all employees with documented acknowledgement of changes.

- Provide updated compliance training that covers what constitutes discrimination and harassment based on new classes to all staff.

- Review job descriptions, advertisements and interview questions to ensure they do not discriminate against newly protected classes.

- Conduct pay audits to identify any potential disparities related to newly protected classes.

- Update record-keeping processes to ensure all complaints, investigations, and actions related to discrimination or harassment are documented and stored securely.

Minimum Wage Increase in Different Jurisdictions

Effective Date: January 1, 2026

What’s Changing? Several jurisdictions in Washington have minimum wages that exceed the state minimum wage and adjust annually to account for inflation.

Washington State’s minimum wage is $17.13 per hour. To be exempt from overtime and other requirements, generally an employee must meet a duties test and in 2026 be paid a salary of at least $1,541.70 per week ($80,168.40 per year).

For an enforceable noncompetition provision, in 2026, an employee must be paid an annualized total compensation (combination of salary, hourly, commissions, etc.) of at least $126,858.83. An independent contractor must receive at least $317,147.09 in annualized compensation from the entity seeking to enforce a noncompetition provision.

For 2026:

Bellingham: $19.13 per hour

Burien (conflict between Burien City Council and ballot measure approved by voters).

Burian City Council

- Employers with 21+ or more full-time employees: $21.63

- Employers with 20 or fewer employees: $17.13

Burien Ballot Measure

- Employers with more than 500 employees nationwide: $21.65 per hour.

- Employers with more than 15 employees but not more than 500 employees: $20.65 per hour

- Employers with 15 or fewer employees: $19.15 per hour.

Employers that employ 15 or fewer employees, regardless of where those employees are employed: $19.15 per hour

Everett

- Employers with 500+ worldwide: $20.77 per hour.

- Employers with 15-500 or annual gross income over $2 million

- January 1 – June 30, 2026: $18.77 per hour.

- July 1 – December 31, 2026: $19.77 per hour.

- Employers with fewer than 15 employees AND gross revenue less than $2 million: $17.13 per hour (state min. wage)

Employers determine which minimum wage applies to them based on the average weekly number of employees and annual gross revenue in 2025

Renton

- Employers with 500 employees worldwide: $21.57 per hour

- Employers with at least 15-500 worldwide OR over $2 million of annual gross revenue in Renton

- January 1 – June 30, 2026: $20.57 per hour

- July 1 – December 31, 2026: $21.57 per hour

- Employers with fewer than 15 employees AND gross revenue less than $2 million: $17.13 per hour (state min. wage)

Employers determine which minimum wage applies to them based on the average weekly number of employees and annual gross revenue in 2025

SeaTec

Sets a different minimum wage for employees in hospitality and transportation industries. Nonexempt employees working in those industries must be paid at least $20.74 per hour beginning January 1, 2026.

Seattle: $21.30 per hour

Tukwila: $21.65 per hour

Unincorporated King County

- Employers with 500 employees: $20.82 per hour

- Employers with 15-500 employees: $19.82 per hour

- Employers with 15 or fewer employees AND an annual gross revenue of $2 million+: $19.82 per hour

- Employers with 15 or fewer employees AND an annual gross revenue of less than $2 million: $18.32 per hour

Employers determine which minimum wage applies to them based on the average weekly number of employees employed during the last 12 months and annual gross revenue in 2025.

What This Means for HR:

- Employers must have their payroll systems ready to apply the correct pay rate no later than January 1, 2026.

—

The information contained in this site is provided for informational purposes only, and should not be construed as legal advice on any subject matter.

- News & Compliance

The Latest includes a brief update on federal and state level news including what happened, the effective date, and what the changes mean for HR.

- Leadership Development

Employees offer input based on what prior experience has taught them. When feedback is mishandled or ignored, they adjust. Silence becomes rational. Silence itself is data. It signals breakdowns in accountability, credibility, or follow-through. HR leaders who want honest feedback must create the conditions that sustain it.

- News & Compliance

The Latest includes a brief update on federal and state level news.